Reading a Receipt Worksheets

About These 15 Worksheets

These worksheets will help to enhance a student’s ability to interpret and understand the information typically found on a receipt. These worksheets not only bolster reading comprehension but also equip students with practical skills necessary for everyday financial literacy.

A receipt, fundamentally, is a document that provides details about a transaction. It often lists items purchased, their individual prices, quantities, subtotal, taxes, discounts, and the total amount paid. These worksheets take these elements and turn them into a series of educational exercises that challenge and develop a student’s analytical and mathematical abilities.

Types of Exercises

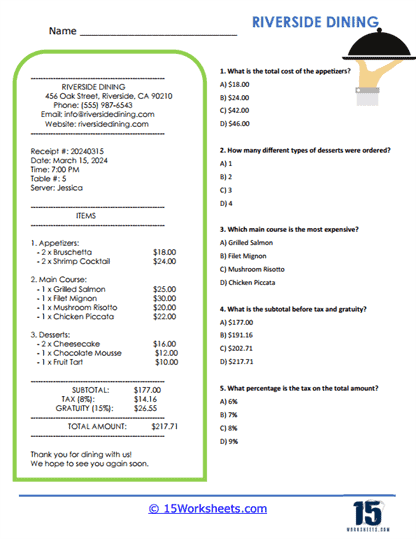

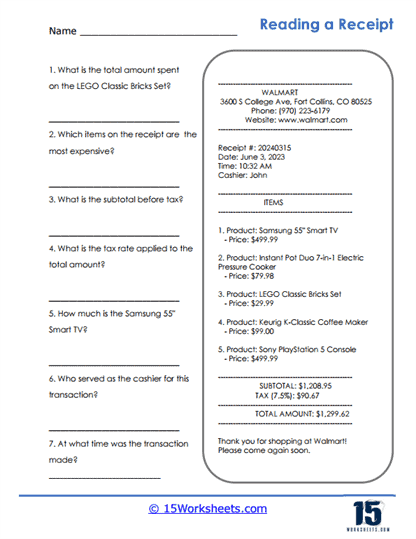

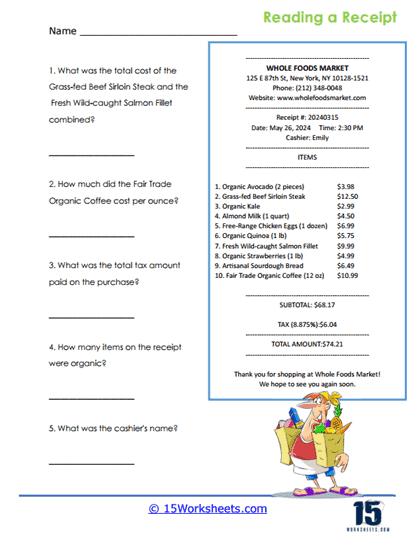

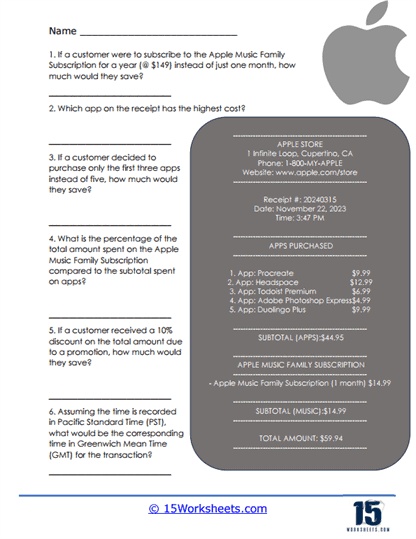

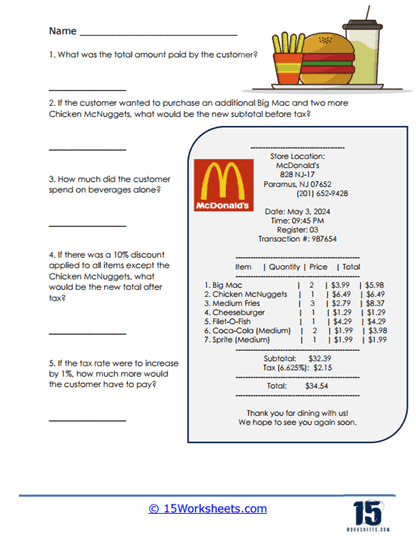

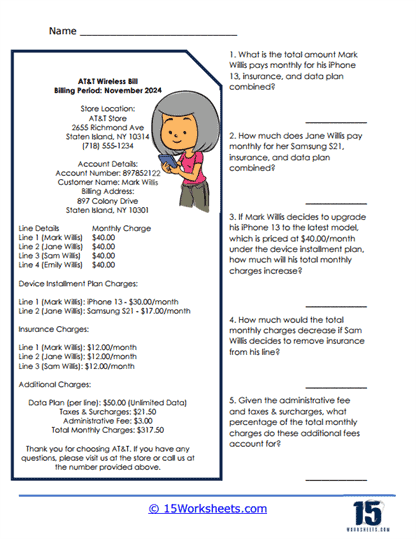

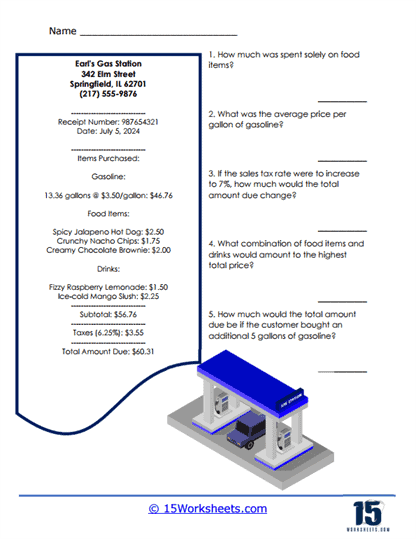

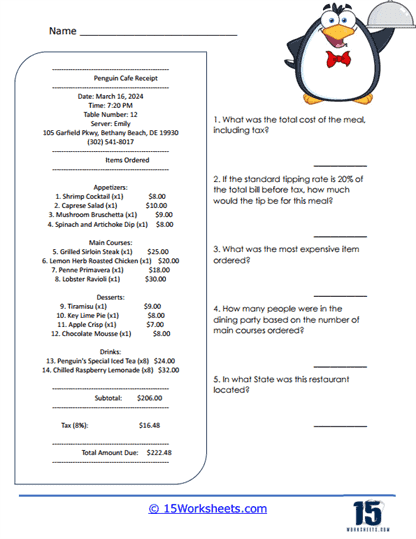

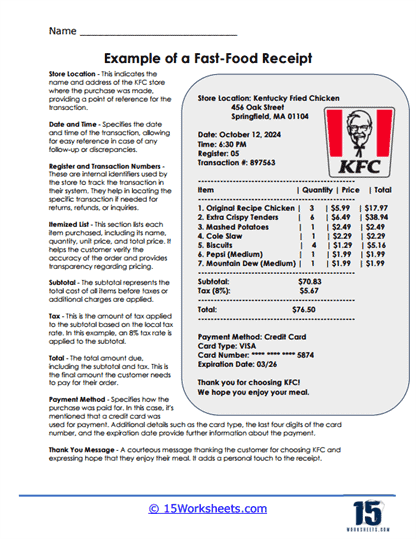

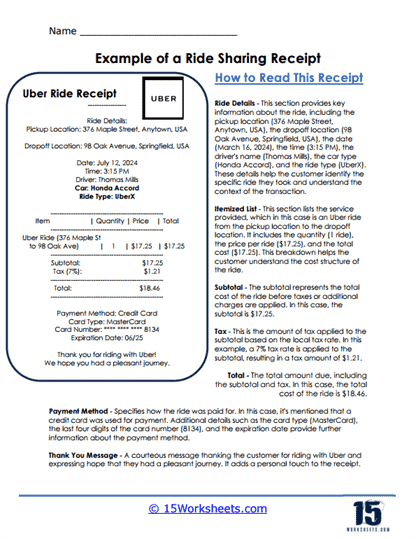

One common type of exercise found on these worksheets is the total cost calculation. Students must look at the prices of individual items and calculate the subtotal. They learn to add up different amounts, ensuring they are comfortable with both whole numbers and decimals, which is crucial for handling money in real-world scenarios.

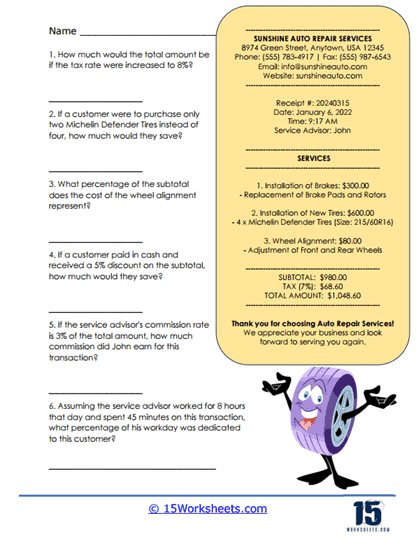

Another exercise focuses on tax calculations. Receipts usually show a tax rate applied to the subtotal. Students must calculate the total tax amount by applying the given percentage rate to the subtotal. This not only reinforces the concept of percentage but also makes students aware of how taxes affect the total cost of purchases.

Discount exercises are also typical. Students may be asked to determine the savings from a discounted item or the final price after a discount is applied. This requires an understanding of percentage and its real-world application in determining sale prices.

Some worksheets incorporate tip calculations, especially on receipts from restaurants. Students must decide how much to tip based on the service percentage suggested or their own judgment, furthering their grasp of percentages and social norms regarding gratuity.

Identifying the most expensive or the least expensive item is another type of exercise. This helps students practice comparison and critical thinking, as they must analyze each item’s cost and make determinations based on the data provided.

Exercises involving unit price calculation are included as well. Students might be asked to determine the cost per unit of an item, which enhances their division skills and aids in understanding bulk pricing and value.

Quantity calculations require students to multiply the price of an item by the number of those items purchased. This solidifies multiplication skills and introduces the concept of bulk buying or the idea of “the more you buy, the more you save.”

Date and time identification on a receipt is another essential exercise. It involves reading and comprehending the date and time format, which may vary by country or region, thus promoting an understanding of different timekeeping methods.

These worksheets can also feature questions about the location where the purchase was made or the identification of the cashier, enhancing attention to detail and situational awareness.

The Benefits of These Worksheets

These worksheets have a direct impact on a student’s reading comprehension by engaging them with practical text and data. It encourages students to focus on details, infer information, and understand the context. This practice can translate into improved academic performance, as the skills needed to dissect a receipt are similar to those required for understanding complex texts in various subjects.

In terms of real-world skills, these worksheets prepare students for daily financial transactions. The ability to read and understand a receipt is a life skill that ensures one can manage purchases, stay within a budget, and spot billing errors. It also makes students aware of consumer rights and responsibilities, such as understanding return policies usually printed on receipts.

By integrating mathematics into the familiar context of shopping, Reading a Receipt Worksheets provide a dual benefit. They offer a real-life application for math skills and promote financial literacy, which is a cornerstone of everyday adult life. The combination of these educational strategies fosters a hands-on approach to learning, making it relevant and engaging for students, and preparing them for independent living.

What Information Is Found On A Receipt?

A basic receipt typically comprises several standard components that itemize and confirm a transaction. Here’s an explanation of each component:

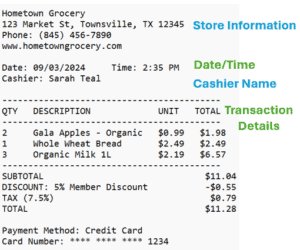

Store Information – This section displays the merchant’s details. It usually includes the name of the store or company, the location (address), contact information (phone number and often an email or website), and sometimes a store number if the business has multiple locations. This information is crucial for identifying the specific store where the transaction occurred, should you need to return an item or have queries regarding the purchase.

Date and Time – The date and time reflect when the transaction took place. This timestamp is not only vital for record-keeping purposes but also important for returns and warranties, as many have time limits. Additionally, the timestamp can be helpful for personal budgeting and expense tracking.

Cashier/Server Name – Many receipts will include the name or identification number of the cashier or server who processed the transaction. This aids in personalizing the service and also provides a point of reference if there’s a need for follow-up due to discrepancies or commendations.

Transaction Details – This core section lists out each item purchased, along with quantities and prices. Each line typically includes a brief description of the item, the unit price, the quantity purchased, and the total price for that number of items. It serves as the detailed account of what the customer is paying for, allowing both the customer and the business to verify the accuracy of the transaction.

Subtotal – The subtotal is the sum of the costs of all items before any additional fees, taxes, or discounts. It’s an important figure because it represents the base price of all goods or services purchased. It’s essential for calculating discounts or taxes which are based on the value of the items before these additional charges.

Taxes – This part of the receipt shows the amount of sales tax applied to the transaction. The tax is calculated as a percentage of the subtotal, which can vary depending on the region’s tax laws and the nature of the items purchased. This is critical for both the customer and the business to ensure that the correct amount of tax is collected and paid to the appropriate tax authorities.

Discounts and Coupons – If any discounts, coupons, or loyalty rewards were applied to the transaction, they are often listed here. This section reduces the subtotal and can be itemized to show each discount’s value, which is helpful for consumers to see the benefits of promotions or membership rewards.

Total – The total amount is arguably the most important figure on a receipt, representing the final amount the customer needs to pay or has paid. This includes the subtotal plus taxes, minus any discounts. It’s the figure that consumers often check to confirm payment and that businesses record as revenue.

Payment Method – This component indicates how the transaction was settled – with cash, credit/debit card, check, gift card, or mobile payment, for example. When paid electronically, the receipt may include the last few digits of the card number for identification without compromising security.

Change Given – If the payment was made in cash, the receipt would show the amount of change returned to the customer. This confirms the cash received and the correct change due, which is essential for maintaining accurate cash handling records.

Return Policy – Often found at the bottom, the return policy informs customers of the terms under which they can return purchased goods. This policy includes the time frame for eligible returns or exchanges and any condition stipulations, such as the items being in their original packaging.

Every component of a receipt has its purpose, either for customer clarity, legal accounting, record-keeping, or promotional activities. Understanding each element is key to effective financial management and consumer awareness.