Money in Words Worksheets

About These 15 Worksheets

These worksheets were specifically designed to enhance students’ understanding and proficiency in dealing with currency through verbal and written exercises. These worksheets encompass a broad spectrum of activities that not only introduce learners to the basics of currency but also challenge them to apply these concepts in various real-world contexts. By engaging with Money in Words Worksheets, students develop a deeper comprehension of monetary values, improve their arithmetic skills, and learn to navigate financial transactions with confidence and accuracy.

The variety of exercises found on these worksheets caters to a wide range of learning objectives, from basic currency recognition to complex financial planning and problem-solving. Regular practice with these worksheets not only improves students’ math and language skills but also prepares them for real-life financial situations, fostering financial awareness, responsibility, and independence. As students progress through the exercises, they develop critical thinking, decision-making, and independent learning skills, all of which are essential for academic success and effective participation in the financial aspects of their lives.

The benefits of practicing with these worksheets highlight the importance of integrating financial literacy into the educational curriculum, equipping students with the knowledge and skills necessary to navigate the complexities of the financial world with confidence and competence.

Types of Exercises

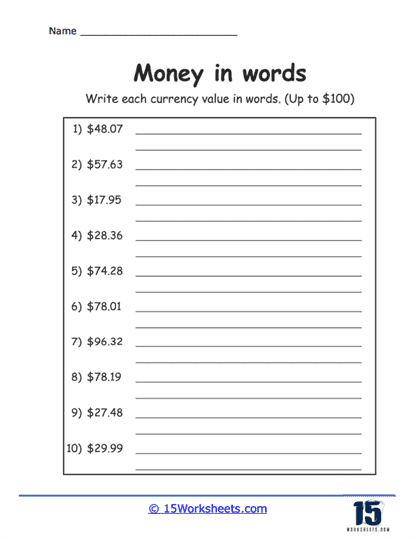

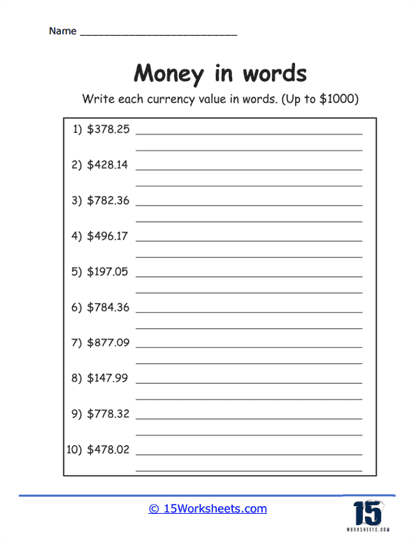

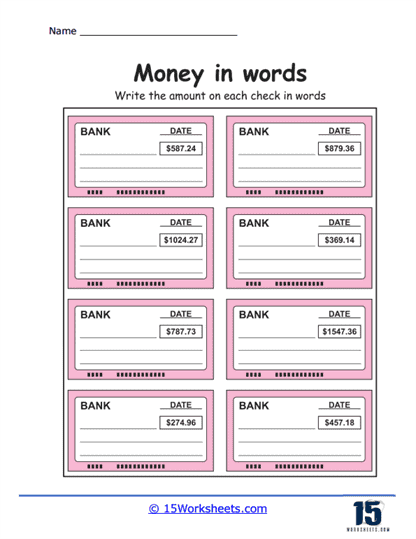

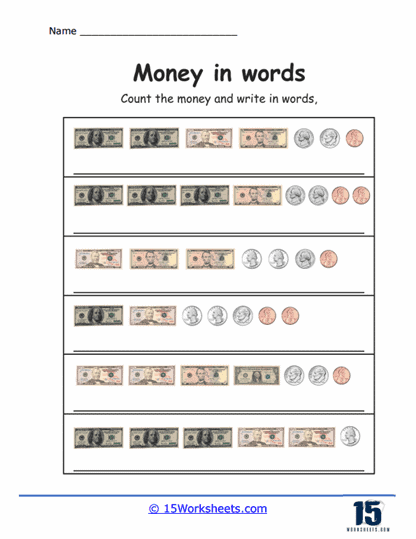

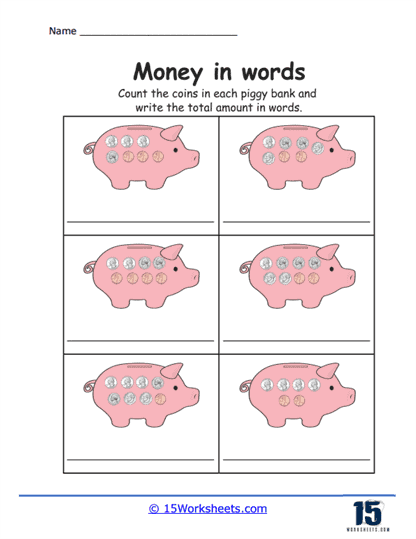

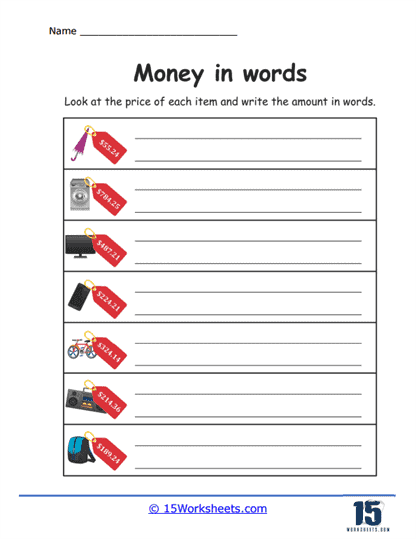

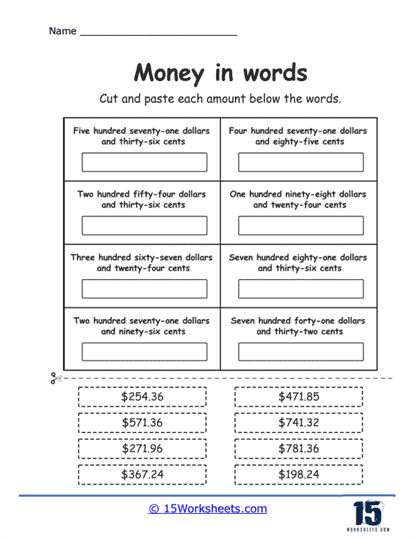

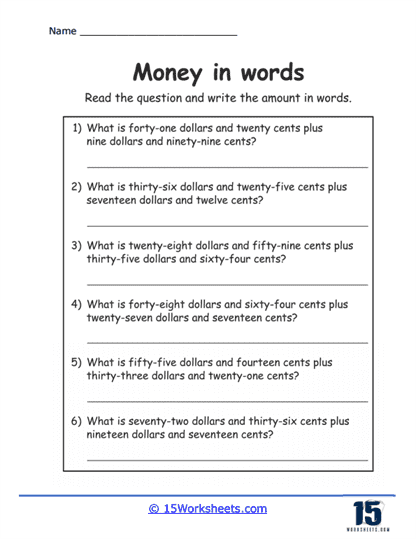

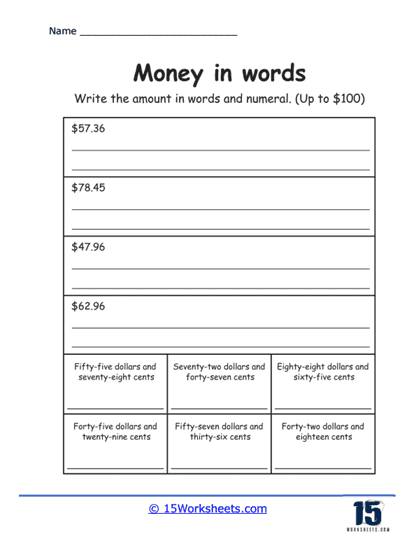

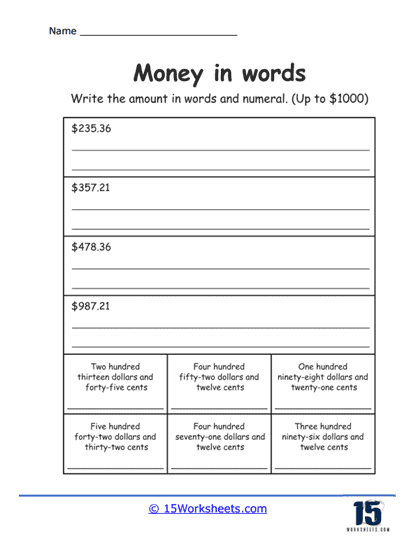

Writing Amounts in Words – These exercises require students to convert numerical representations of money into written words. For instance, transforming “$5.25” into “five dollars and twenty-five cents.” This practice reinforces the understanding of currency values and enhances literacy skills.

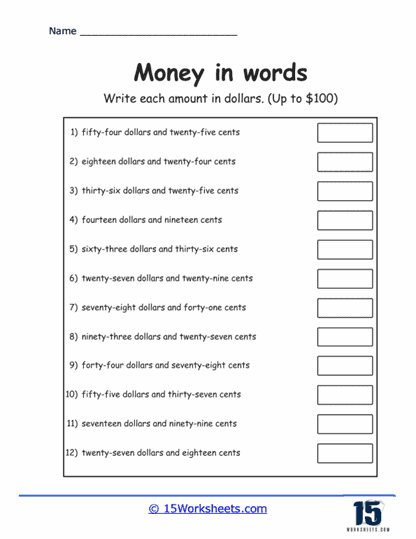

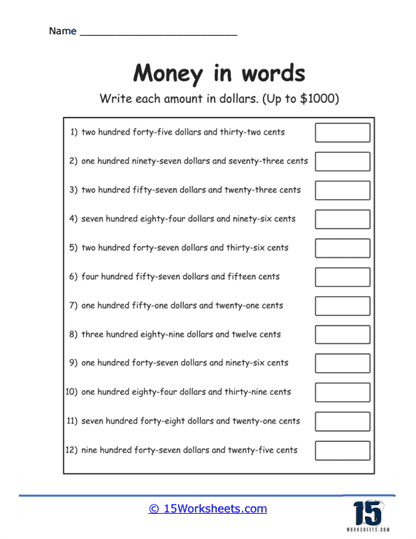

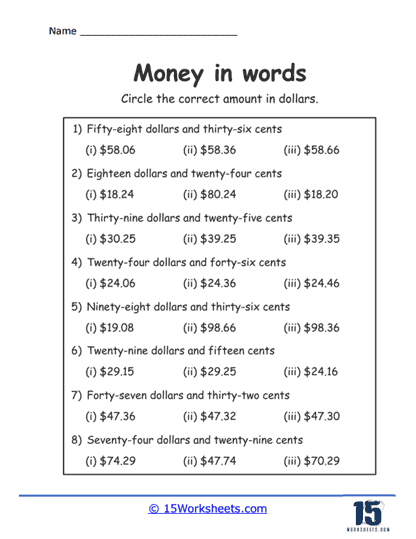

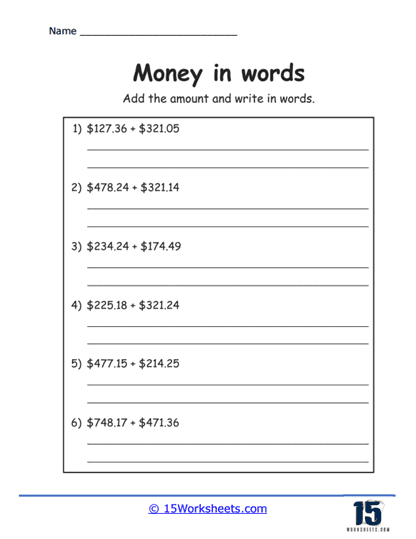

Reading Amounts in Words and Converting to Numbers – The reverse of writing amounts in words, this activity challenges students to read monetary values written out in words and then express them in numerical form. It’s an excellent way to ensure comprehension and reinforce numerical literacy. Students are given scenarios where they must calculate total costs of items or change due from transactions, expressing their answers in words. This type of exercise integrates math skills with literacy, applying practical transaction knowledge.

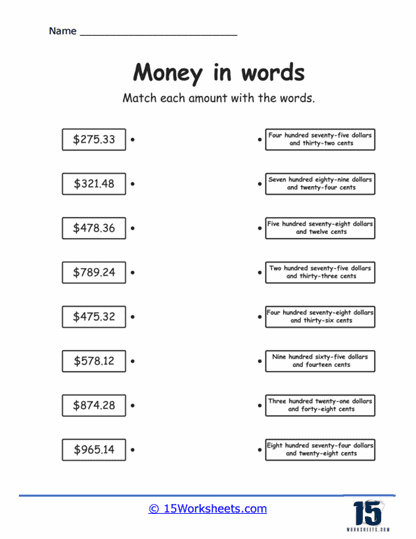

Matching Numerical and Word Forms – In these exercises, students are given a list of monetary amounts in numbers alongside a list in word form and are asked to match each pair correctly. This activity strengthens the association between numerical values and their word counterparts. Worksheets may include sentences with missing monetary values, where students must fill in the blanks with the correct amount in words, based on context clues. This practice improves both financial literacy and contextual understanding.

Comparing Amounts – Exercises that involve comparing monetary values, asking students to write out which of two amounts is greater or if they are equal, all in words. This not only tests their understanding of value but also their ability to articulate financial comparisons. More complex worksheets feature word problems that require solving financial scenarios—such as calculating total expenses, savings, or budgeting—where students must provide their answers in written words. These problems enhance critical thinking and problem-solving skills.

The Benefits of These Worksheets

These worksheets offer a comprehensive approach to enhancing students’ educational journey by blending financial literacy with numerical and language skills. These worksheets serve as a pivotal educational tool, facilitating a deeper understanding of currency through engaging and diverse exercises. The continuous interaction with monetary values not only familiarizes students with the basic concepts of currency, including the significance of various coins and bills, but also intricately ties these concepts to practical transactions. This foundational knowledge is crucial, laying the groundwork for the development of sound money management habits that students will carry into their adult lives.

One of the standout benefits of these worksheets is the enhancement of numerical literacy. The act of converting numbers to words and vice versa does more than just reinforce students’ ability to work with numbers; it ensures a level of comfort and familiarity with numerical data that is invaluable. This skill, essential in both academic pursuits and daily life, broadens their mathematical capabilities, making students more adept at navigating numerical challenges across various contexts.

This type of work can significantly bolster language and writing skills. The requirement to write out monetary values in words offers an excellent opportunity for students to refine their spelling, grammar, and overall literacy. This task demands precision in language use, enhancing students’ competency in communicating financial matters effectively. The integration of financial literacy with language skills not only enriches students’ understanding but also equips them with the ability to articulate complex financial concepts clearly and accurately.

The practical application of math through these worksheets demonstrates the real-life relevance of mathematical skills. By requiring students to apply arithmetic operations in scenarios that mimic real-life transactions, such as making purchases or calculating change, students can see firsthand the utility of math beyond the classroom. This application not only solidifies their mathematical understanding but also showcases the direct impact of these skills on daily activities, thus reinforcing the importance and applicability of math in everyday life.

Confidence in handling money is another significant benefit derived from regular practice with these worksheets. As students become more proficient in understanding and articulating monetary values, their confidence in managing financial transactions grows. This newfound confidence is essential for effectively navigating various financial aspects of life, from simple shopping trips to more complex budgeting and financial planning tasks.