Counting Money Worksheets

About These 15 Worksheets

These worksheets were created to enhance the financial literacy and mathematical skills of students by focusing on currency calculation and management. These worksheets encompass a wide array of exercises that cater to various learning levels, from beginners who are just starting to recognize and value different denominations to more advanced students learning to manage transactions and budgeting. Engaging with these worksheets not only solidifies foundational math skills but also equips students with the practical knowledge necessary for navigating real-world financial scenarios.

The diverse types of exercises available cater to a wide range of learning levels and objectives, from basic currency recognition to complex financial planning and problem-solving. Regular engagement with these worksheets not only enhances students’ numeracy and problem-solving skills but also prepares them for real-life financial situations, fostering financial awareness, responsibility, and independence.

As students progress through the exercises, they develop critical thinking, decision-making, and independent learning skills, all of which are essential for academic success and effective participation in the financial aspects of their lives. The benefits of practicing with Counting Money Worksheets underscore the importance of integrating financial literacy into the educational curriculum, equipping students with the knowledge and skills necessary to navigate the complexities of the financial world with confidence and competence.

Types of Exercises

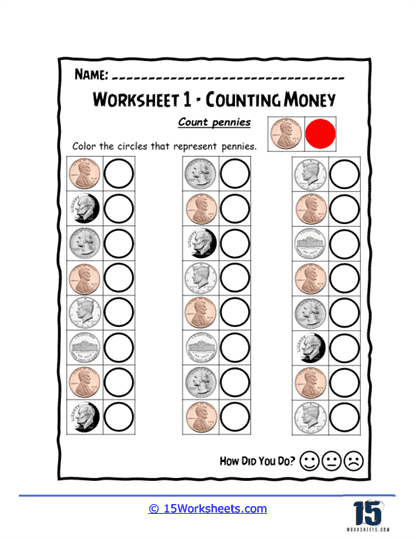

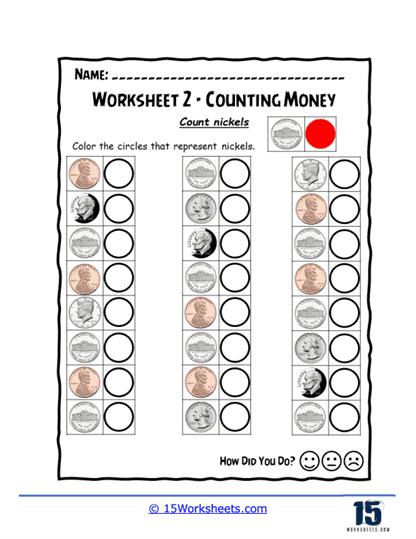

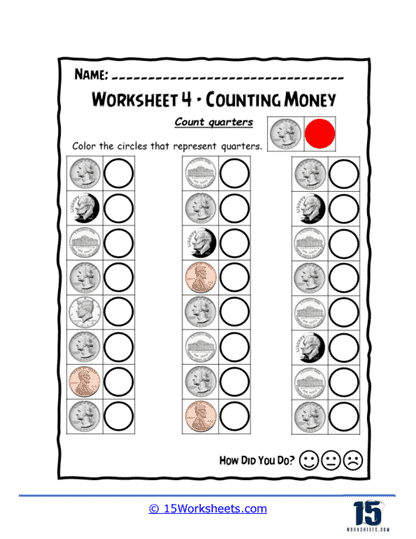

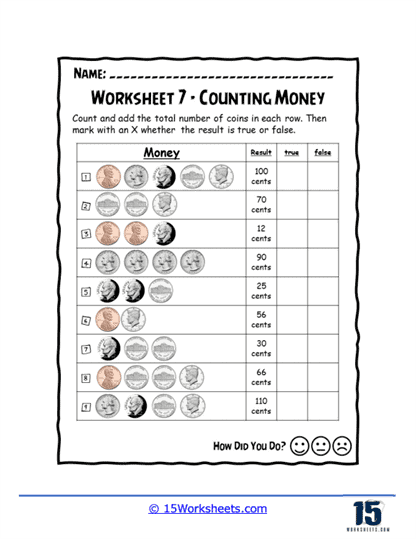

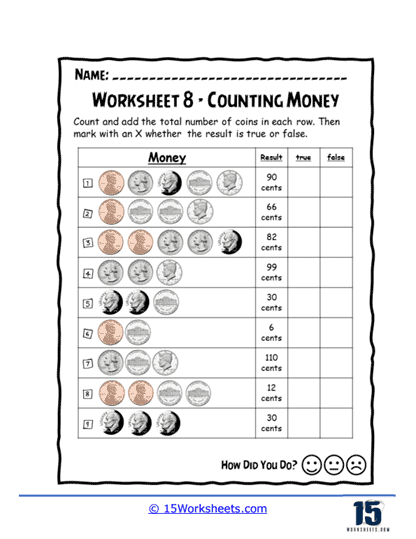

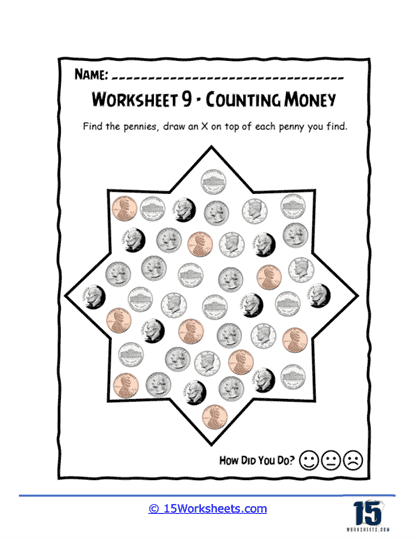

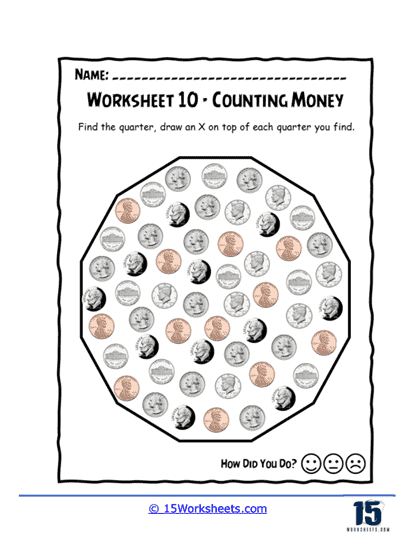

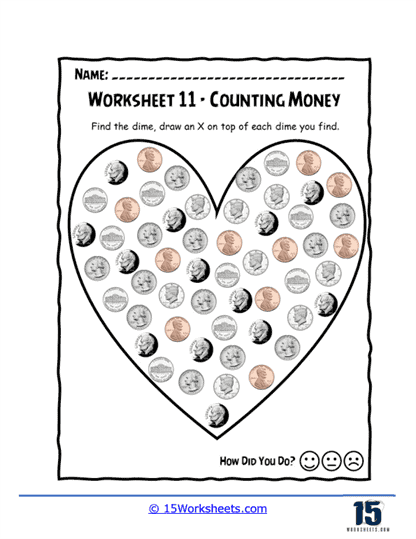

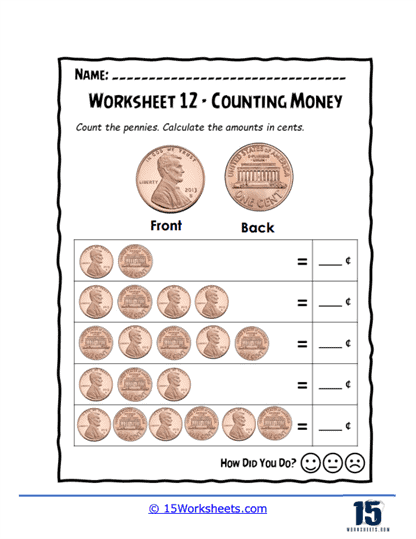

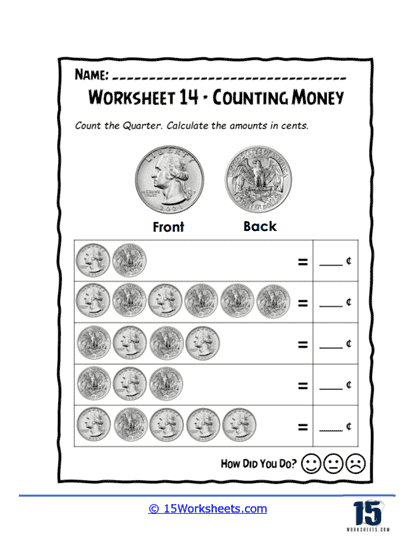

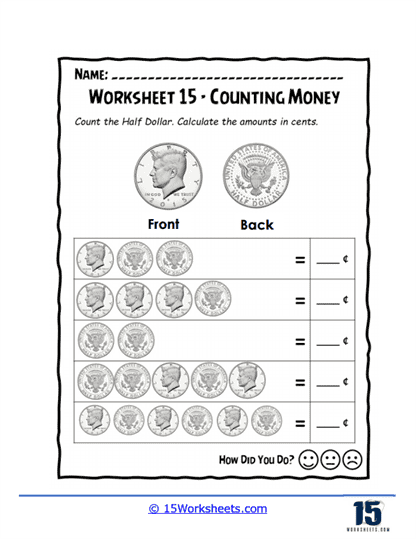

Identification and Value Recognition – These exercises introduce students to different types of currency, including coins and bills. Students learn to identify each denomination by its physical characteristics and understand its value. This basic step is crucial for building a foundation in financial literacy.

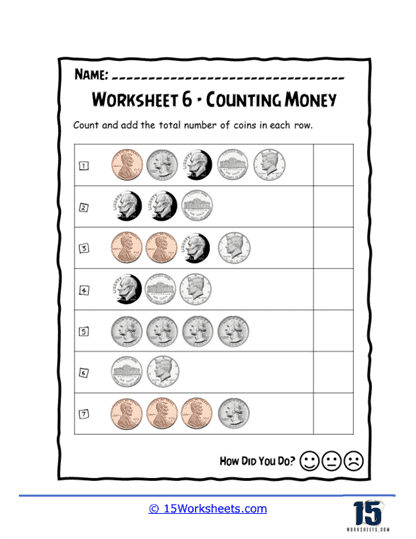

Simple Addition and Subtraction – Once students can recognize different denominations, worksheets often present exercises that require adding and subtracting amounts of money. This practice reinforces basic arithmetic skills while applying them to practical financial contexts.

Making Change – Advanced worksheets challenge students to calculate the change required from transactions. This involves both subtraction to determine the difference between the cost and the amount paid, and addition to figure out the combination of coins and bills to be returned as change. Such exercises are vital for developing a deeper understanding of everyday financial transactions. Students are tasked with finding different combinations of coins and bills that equal the same amount. This type of exercise encourages flexible thinking about value and introduces the concept of equivalence in a financial context.

Comparing and Ordering Values – Exercises that ask students to compare and order sets of coins and bills from least to greatest value enhance their analytical skills. These tasks also help students understand the relative value of money and improve their ability to make financial decisions.

Budgeting Exercises – For more advanced students, worksheets may include budgeting exercises where they need to allocate a set amount of money across various needs and wants. This not only tests their addition and subtraction skills but also introduces essential concepts of financial planning and prioritization. Incorporating word problems into counting money worksheets helps bridge the gap between abstract math skills and real-world application. These problems often involve scenarios that require calculating total costs, determining change, or figuring out how many of a certain item one can buy with a given amount of money.

The Benefits Of These Worksheets

These worksheets provides a comprehensive suite of benefits that are instrumental in shaping a student’s academic and practical life skills. These worksheets, designed to blend mathematical exercises with financial concepts, offer a multifaceted approach to learning that touches on several key areas of development. By engaging with these resources, students not only refine their arithmetic abilities but also gain valuable insights into financial management, decision-making, and real-world application of math, fostering a well-rounded educational experience.

The primary advantage of these worksheets is the significant improvement they bring to students’ numeracy skills. Regular engagement with tasks that require addition, subtraction, multiplication, and division in the context of money calculations sharpens these basic arithmetic abilities. The mastery of such skills is not only a cornerstone for academic achievement across various subjects but also a critical competency for everyday financial tasks. Whether it’s calculating change, understanding billing statements, or managing allowances, the ability to perform quick and accurate mathematical operations is invaluable.

These types of worksheets play a crucial role in enhancing financial literacy among students. Through repeated exposure to currency recognition, understanding the value of different denominations, and navigating transactions, students develop a solid foundation in how money functions in society. This knowledge is pivotal in cultivating responsible spending and saving habits from an early age. By understanding the worth of money and the principles of financial exchange, students are better equipped to make judicious decisions regarding their finances, setting the stage for a lifetime of prudent financial management.

The application of math skills to money-related exercises introduces students to the concept of real-world math. This practical application bridges the gap between theoretical mathematical concepts learned in class and their use in everyday financial scenarios, such as making purchases, receiving change, and budgeting. Such activities not only reinforce the students’ math skills but also enhance their understanding and retention of these concepts, demonstrating the relevance of math in daily life and encouraging a more engaged learning process.

This type of work can also be instrumental in fostering problem-solving skills. The diverse range of exercises challenges students to apply their mathematical and financial knowledge in various situations, from simple calculations to complex budgeting scenarios. This practice develops critical thinking and analytical skills, empowering students to approach problems methodically and creatively find solutions. The ability to solve problems effectively is a skill that transcends academic boundaries, proving invaluable in personal, professional, and societal contexts.

Introducing students to the critical aspect of financial decision-making. Through tasks that simulate budgeting and spending decisions, students learn the importance of evaluating options and making informed choices about how to use their money. This early introduction to financial decision-making equips students with the skills needed for future financial independence and responsibility, preparing them to navigate the complexities of personal finance with confidence.

An often-overlooked benefit of counting money worksheets is the promotion of independent learning. As students work through these exercises, they have the opportunity to practice and reinforce their skills at their own pace, fostering a sense of autonomy and self-directed learning. This independence not only builds confidence in their abilities but also instills a sense of motivation and self-discipline, qualities that are essential for lifelong learning and personal development.

The proficiency gained in counting and managing money through these exercises significantly boosts students’ confidence in handling real-world financial transactions. This increased confidence is crucial for effective participation in the economy and for managing personal finances. As students grow more comfortable with financial concepts and calculations, they become more competent in making transactions, planning expenditures, and saving for the future, laying a strong foundation for financial stability and success.