Making Change Worksheets

About These 15 Worksheets

These worksheets will help teach students how to calculate the change due in transactions, a fundamental skill in financial literacy and practical mathematics. These worksheets offer a variety of exercises that simulate real-world shopping experiences, where understanding currency and making accurate change is crucial. Through repeated practice, students develop a deeper understanding of basic currency concepts, improve their arithmetic skills, and become more adept at handling real-life financial situations.

The diverse types of exercises available cater to a wide range of learning levels and objectives, from basic currency recognition to complex financial planning and problem-solving. Regular engagement with these worksheets not only enhances students’ numeracy and problem-solving skills but also prepares them for real-life financial situations, fostering financial awareness, responsibility, and independence.

As students progress through the exercises, they develop critical thinking, decision-making, and independent learning skills, all of which are essential for academic success and effective participation in the financial aspects of their lives. The benefits of practicing with Making Change Worksheets underscore the importance of integrating financial literacy into the educational curriculum, equipping students with the knowledge and skills necessary to navigate the complexities of the financial world with confidence and competence.

Types of Exercises

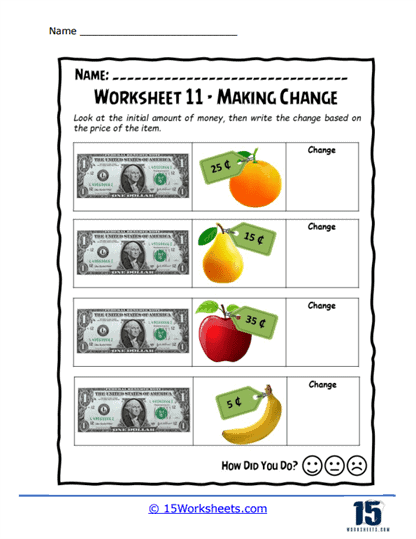

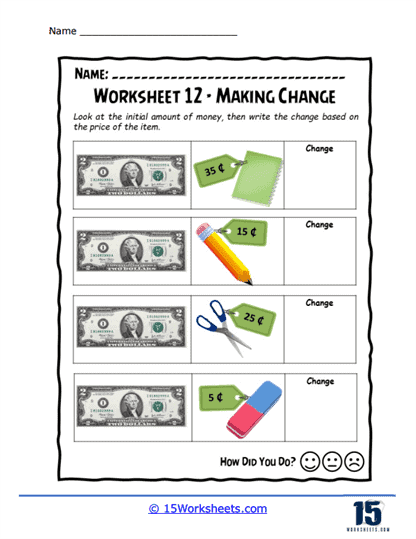

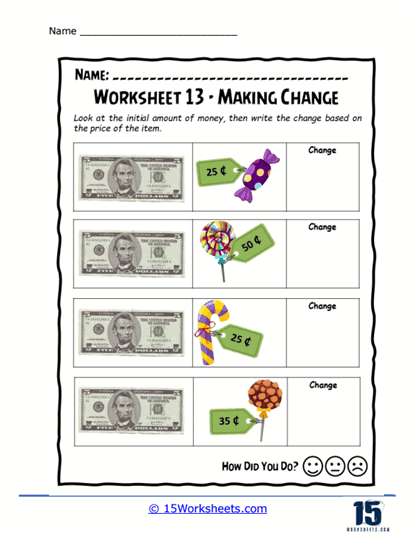

Recognizing Currency – The first step in making change is understanding the value of different coins and bills. Exercises often start with identifying and comparing the values of currency, helping students become familiar with the denominations used in their country.

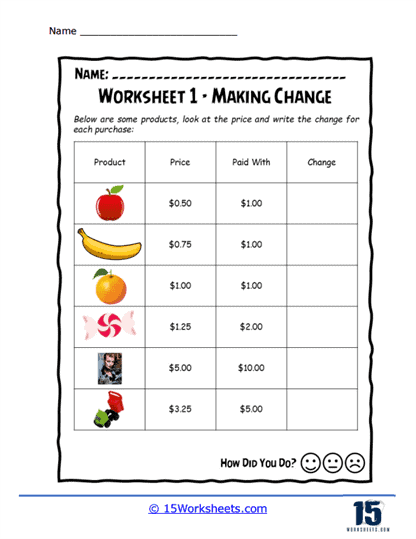

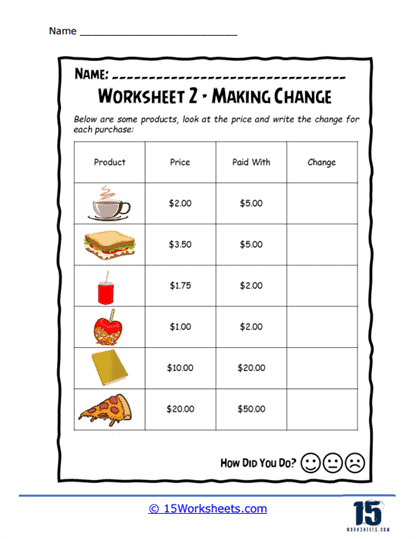

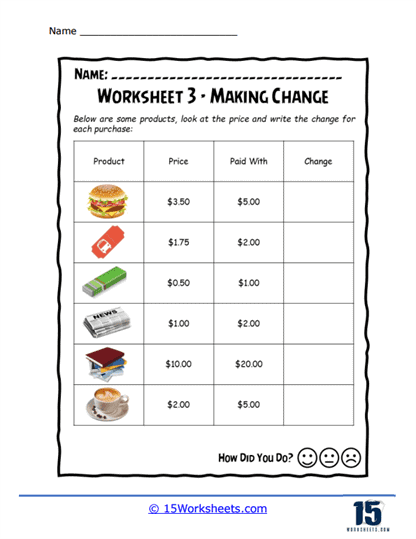

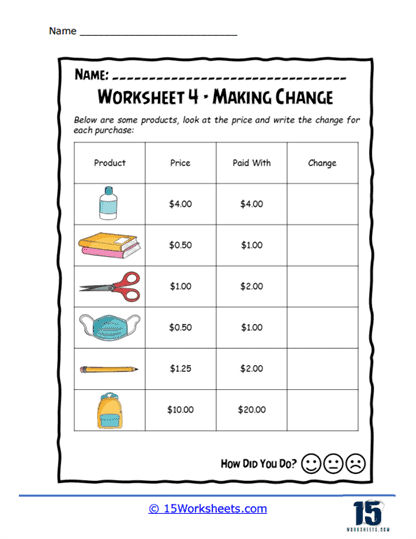

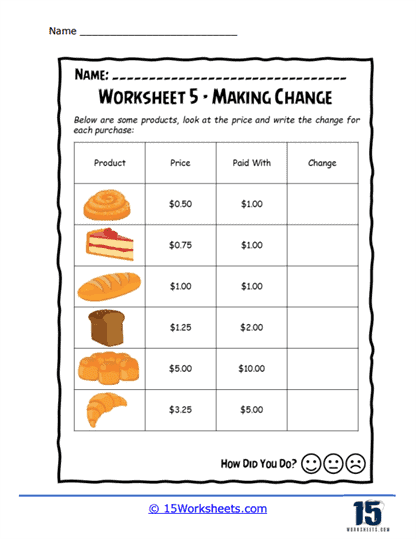

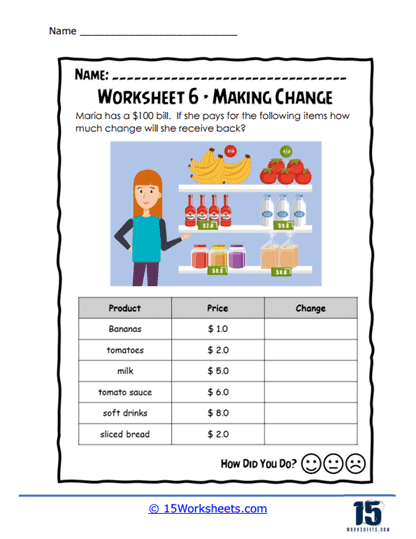

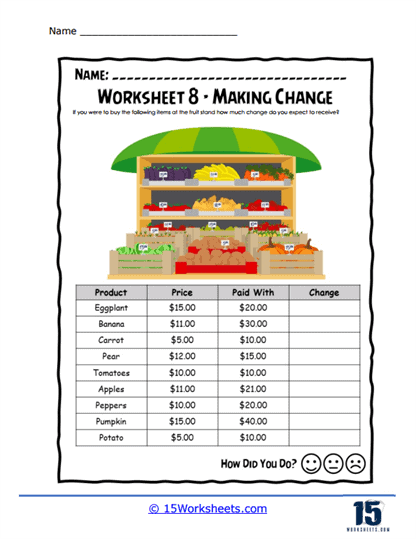

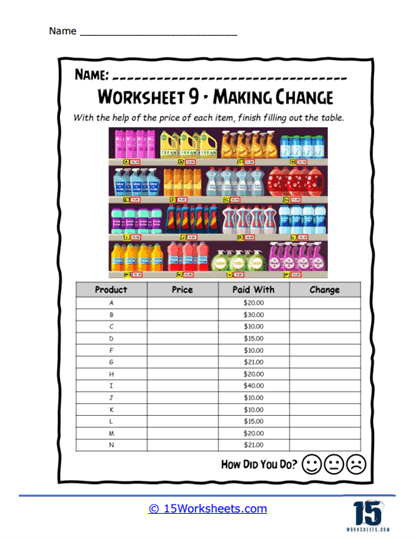

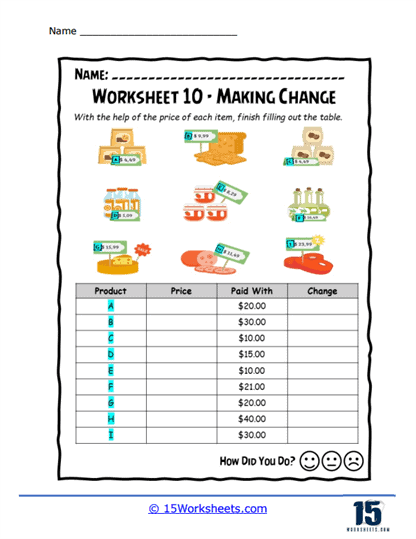

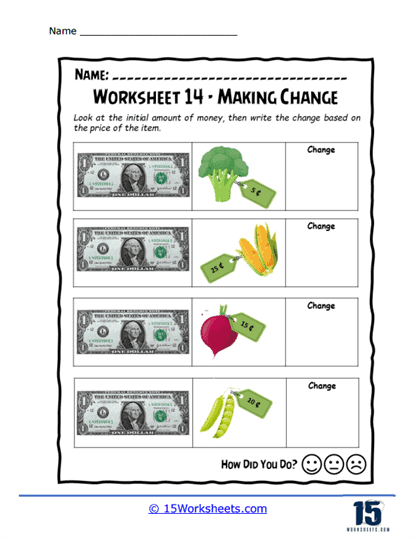

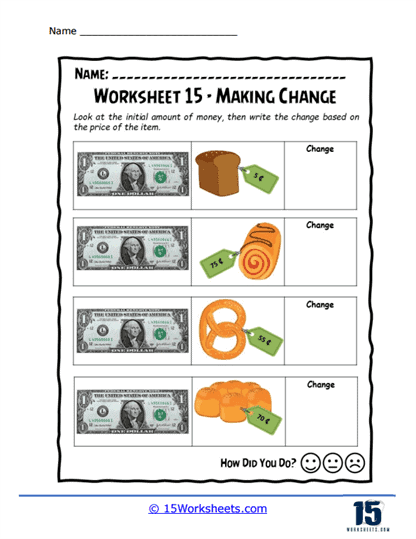

Basic Change Calculation – These exercises present simple transactions where a customer pays with a bill that is a higher denomination than the cost of the item purchased. Students calculate the difference between the two amounts to find the change due. This practice reinforces basic subtraction skills.

Complex Change-Making Scenarios – As students advance, they encounter more complex transactions involving multiple items, sales tax, or discounts. These scenarios require students to add the cost of items, calculate tax, subtract discounts, and then determine the change from a given amount, integrating multiple math skills. In these exercises, students are challenged to make change using the smallest number of coins or bills possible. This encourages students to think strategically about the way change is made and understand the concept of equivalent values.

Role-Playing Activities – Some worksheets include activities where students take on the roles of cashier and customer. These interactive exercises provide a hands-on approach to learning how to make change, enhancing the educational experience through simulation. Word problems add context to the skill of making change, requiring students to apply their knowledge in narrative-based scenarios. These problems can vary in complexity and often integrate real-life situations, such as shopping at a store or dining at a restaurant.

The Benefits of These Worksheets

These worksheets not only enhances a student’s mathematical skills but also provides a comprehensive approach to understanding and managing finances effectively in real-world scenarios. These worksheets are designed to simulate everyday transactions, thereby teaching students the practical application of math through the lens of financial literacy. The exercises vary in complexity, from basic arithmetic to more nuanced financial transactions, ensuring that students at different learning stages can benefit.

The primary advantage of engaging with these worksheets is the significant improvement in numeracy skills. Through regular practice, students refine their ability to perform essential arithmetic operations such as addition, subtraction, multiplication, and division. These skills are foundational for accurately calculating change, a task that is not only common but essential in daily transactions. By mastering these operations, students develop a strong mathematical foundation that supports their academic growth and real-life problem-solving capabilities.

This type of work can serve as an introductory platform to essential financial literacy concepts. Students become familiar with different currencies, understanding the value of various coins and bills, and the processes involved in making transactions. This early exposure to financial concepts is crucial in developing responsible money management habits and a solid understanding of the value of money. It lays the groundwork for more complex financial education, such as budgeting, saving, and investing, which are pivotal for long-term financial well-being.

The real-world application of math through these worksheets cannot be overstated. By simulating shopping scenarios and other transactions, students learn to apply mathematical concepts in practical situations. This hands-on approach reinforces the relevance of math in daily life, bridging the gap between theoretical knowledge and practical application. Students who understand how to apply math in real-life contexts are more likely to appreciate the subject and recognize its importance beyond the classroom.